In 2023, faced with the combined effects of complex external environments such as continued geopolitical risks, high energy and raw material prices, and progressively lower interest rates, the economic growth of developed economies will further slow down; in contrast, emerging markets and developing countries The economy has shown a relatively stable economic situation. Against this background, the pump industry has also demonstrated its strong ability to withstand pressure and its advantages of flexibility.

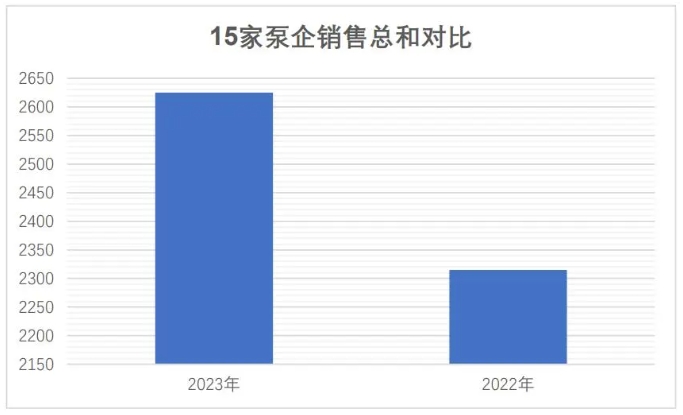

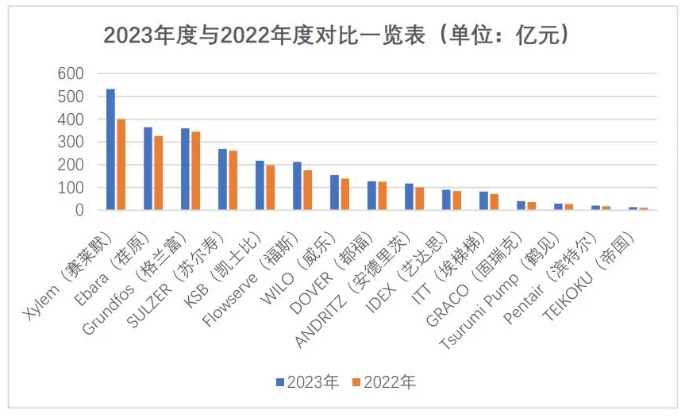

According to statistics, the total annual sales of the 15 internationally renowned pump companies included in the annual summary reached approximately 262.5 billion yuan, a year-on-year growth of 13.4% compared to 231.5 billion yuan in 2022. Among these 15 companies, what is particularly noteworthy is that 9 companies have achieved strong growth of more than double digits.

A closer look at the annual reports of various companies shows that the driving forces behind their performance growth mainly come from the following aspects: first, the service demand for equipment updates and iterations in the existing market; second, the activity in the field of infrastructure construction and renovation; third, water treatment and municipal engineering The expansion of the market; the fourth is the in-depth exploration and intensive cultivation of each enterprise in various subdivisions.

Figure 3 Overview of international pump sales in 2023

Note: In the above charts, the exchange rates are different due to different conversion times, and the data have been rounded and are for reference only.

In addition to sales revenue, each manufacturer’s report also includes order statistics. Because it involves New Year’s Eve and delivery time issues, we will not explain them one by one here. In addition, some manufacturers have calculated data for the whole year of 2023 based on quarterly statistics due to the difference in fiscal year time.

picture

Outlook 2024

According to the World Bank’s latest forecast of global economic trends, global economic growth is expected to decline to 2.4% in 2024, marking the third consecutive year of deceleration in global economic growth. Tighter monetary policy and tighter credit conditions, along with weakening global trade and investment activity, are seen as key factors contributing to sluggish growth. Faced with multiple complex dynamics at home and abroad, emerging market economies and developing economies have experienced significant divergence in their growth expectations.

It is expected that in 2024, economic growth in East Asia and the Pacific (including China), Europe and Central Asia, and South Asia will all experience a certain degree of slowdown. On the other hand, growth expectations in other parts of the world show signs of rebound to varying degrees. Specifically, the World Bank predicts that the economic growth rate in East Asia and the Pacific will slip to 4.5% in 2024, and the growth rate in Europe and Central Asia will also slow down to 2.4%; the economic growth rate in Latin America and the Caribbean is expected to be slightly lower. The rate increased to 2.3%.

To sum up, while the pump industry faces the challenges of a general slowdown in the global economy, there are also opportunities brought about by economic structural adjustment and regional differentiated growth.

In the follow-up, we will provide an analysis of the sales situation of China’s pump industry in 2023, so stay tuned!

Post time: Apr-20-2024